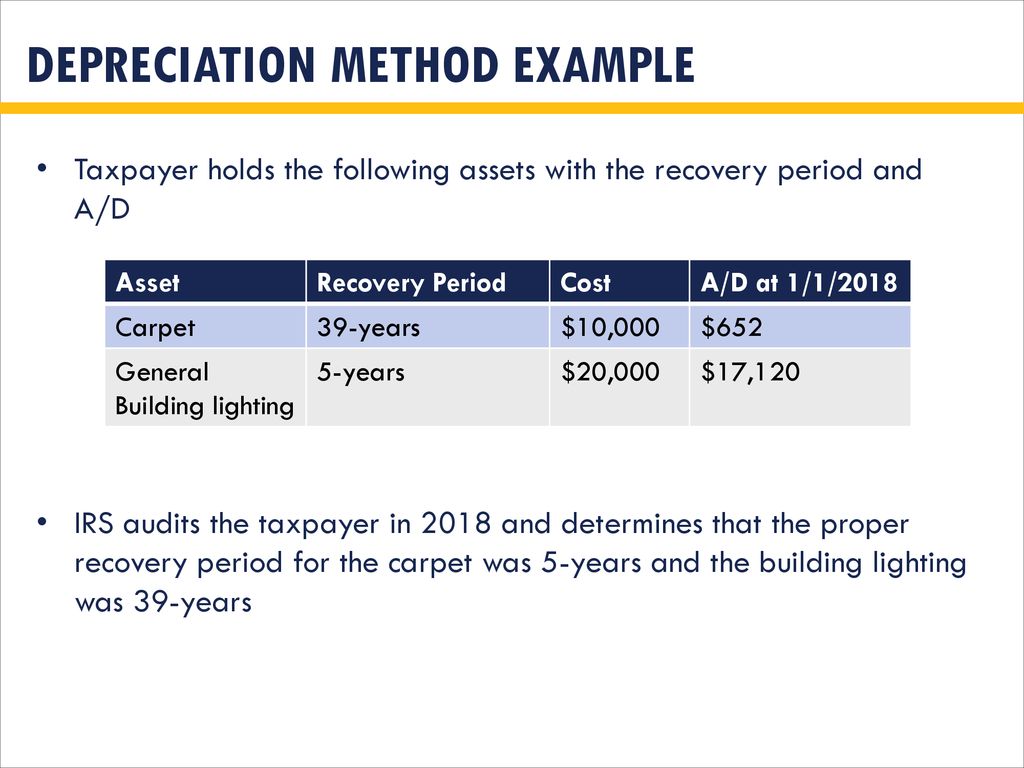

Thus the irs does not think that all residential rental carpets only lasts five years but the irs does think that most such carpets last between five and nine years based on a study of carpets by the irs.

Irs carpet depreciation life.

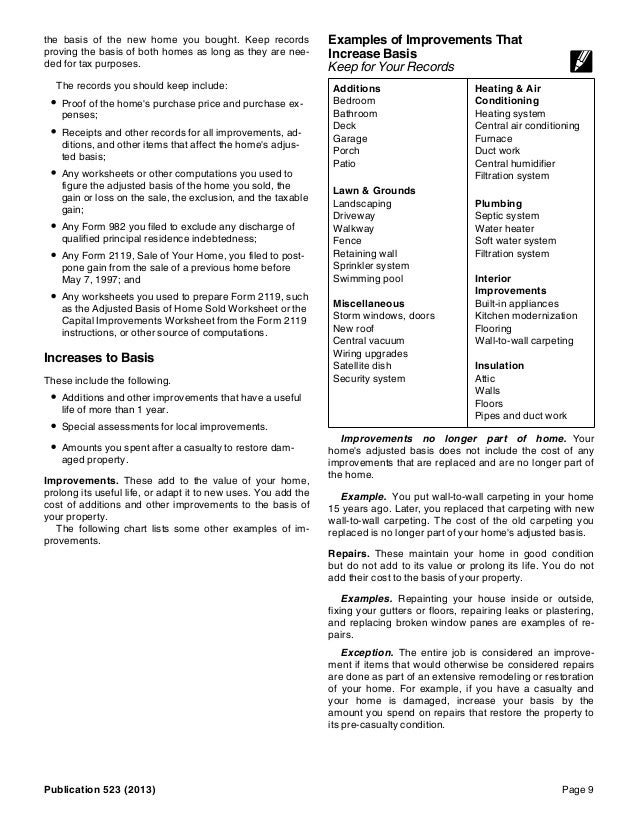

Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above.

Income tax return for an s corporation regardless of when it was placed in service.

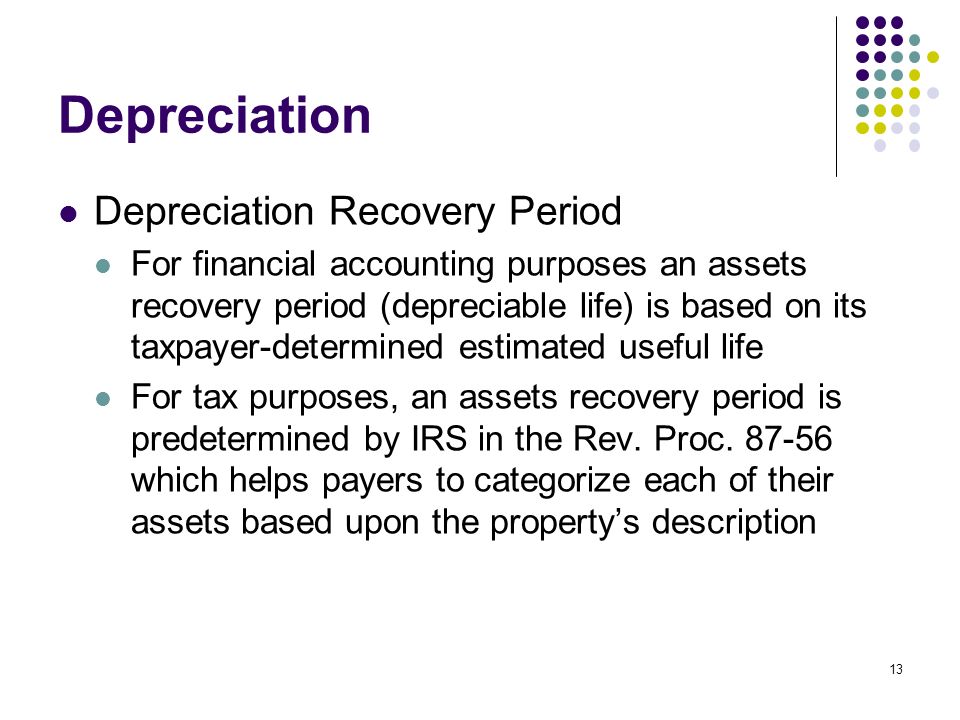

For further information you can refer to the table of class lives and recovery periods in irs publication 946 how to depreciate property.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

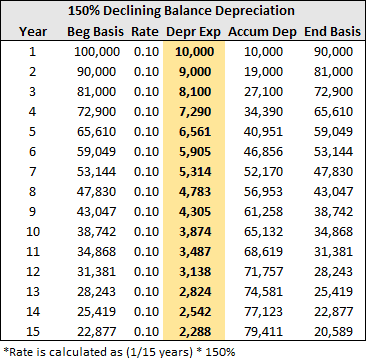

Useful life of more than 4 but less than 10 years that is 5 9 years.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Depreciation or amortization on any asset on a corporate income tax return other than form 1120 s u s.

You must submit a separate form 4562 for each business or activity on your return for which a form 4562 is required.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.