You receive payment of a premium from st george to purchase the interest rate floor which offsets the premium that you pay for the interest rate cap.

Interest rate cap and floor investopedia.

The floor guarantees a minimum rate to the buyer.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

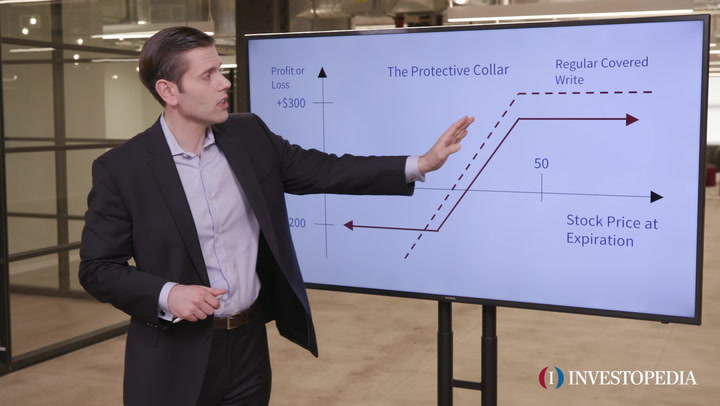

As such the premiums payable for an interest rate collar are less than the premium payable for.

An investment in a derivative using an interest rate cap or floor requires the buyer to pay a premium to purchase the option so the buyer faces some form of credit risk.

Time 0 5 6 004 0 470 4 721 0 021 35 0 06004 0 04721 0 470 0 021 ir modeling a capped floater consider an investor holding a 2 year.

It has value only when the rate is above the guaranteed rate otherwise it is worthless.

Interest rates standard options are caps and floors the cap guarantees a maximum rate to the buyer.

Indeed its interest rate delta is negative.

Interest rate sensitivity of a cap the cap pays off when interest rates go up.

Interest rate cap and floor an interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price.

Caps and floors are based on interest rates and have multiple settlement dates a single data cap is a caplet and a single date floor is a floorlet.

The highest point to which an adjustable rate mortgage arm can rise in a given time period or the highest rate that investors can receive on a floating rate type bond.

Therefore it is a bearish position in the bond market.

Caps and floors are based on interest rates and have multiple settlement dates.

Interest rate caps and floors are option like contracts which are customized and negotiated by two parties.

A cap is an option.

Borrowers are interested by caps since they set a maximum paid interest cost.

Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end.

An interest rate cap is an otc derivative where the buyer receives payments at the end of each period when the interest rate exceeds the strike whereas an i.

An example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

An interest rate cap protects the buyer from interest rates rising above the strike rate.

Interest rate floors are utilized in derivative.

:max_bytes(150000):strip_icc()/dotdash_Final_Evaluating_the_Board_of_Directors_Feb_2020-01-e4e970ac854b40c094ddba1e007e1e09.jpg)

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_Stocks_That_Hit_All-Time_Highs_Jul_2020-01-d761dea2844f4b028c646429958053df.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Knock_In_Option_Apr_2020-01-ea2e95a4d5af4c96aa23b7c3e185f498.jpg)

:max_bytes(150000):strip_icc()/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

:max_bytes(150000):strip_icc()/dotdash_FINAL_Diversification_Its_All_About_Asset_Class_Jan_2020-fe0eea99d53d4883824b1859f899627c.jpg)

/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

:max_bytes(150000):strip_icc()/symbol-1757582_1920-bf9423ed95d84812910b7298caad746c.png)

.png)